nyobs

nyobs

nyobs

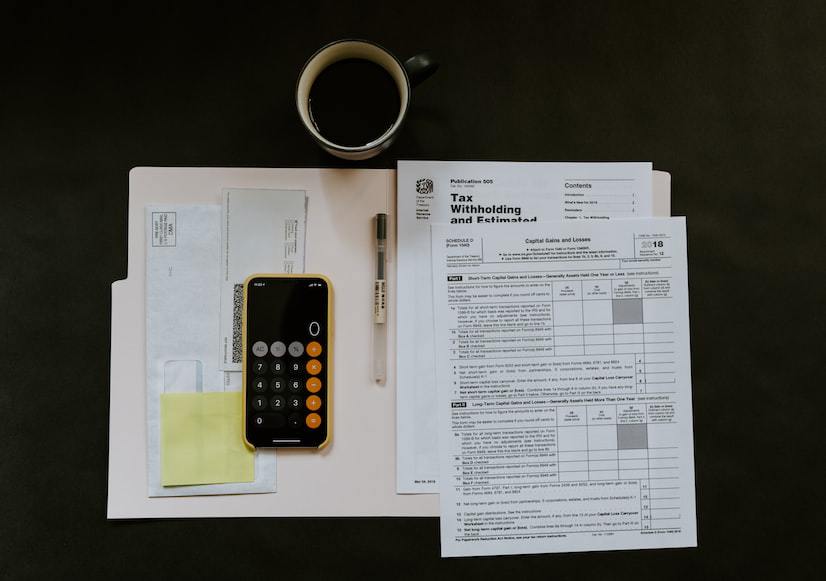

Tax System in Indonesia – Before the inception of the Integrated Information System, the Indonesian government faced the obstacle of not being able to gain information about the flow of cash and goods. Recently, there is a problem regarding the export quota for Crude Palm Oil (CPO). Furthermore, information regarding the flow of cash and goods is also important since it directly affects the intensification of the country’s income, which is tax.

To further integrate the information system, the government has tried several solutions. First, introduce the Automatic Exchange of Information (AEOI), an information system to help the tax matters of companies in the banking, stock market, insurance sectors. Second, involving the National Land Agency (Badan Pertanahan Nasional) and Notary to gain information regarding the ownership of tax-mandatory properties such as land and building. Third, involving the Regional Revenue Department (Dinas Pendapatan Daerah) and One-Stop Administration Services Office (SAMSAT) to gain information on the ownership of tax-mandatory objects, specifically cars, motorcycles, and other vehicles. Fourth, mending the Law of Value-Added (VAT) Tax, done by changing some of the goods/services that are not previously VAT Tax objects into VAT Tax objects.

With the inception of the Rule Number PER-03/PJ/2022 in the tax system in Indonesia, the Directorate General of Tax is trying to introduce the use of ID Number (Nomor Induk Kependudukan) in order to oversee the flow of cash and goods. With this newly introduced rule, the government will be able to identify the tax-mandatory income of Indonesian citizens, specially those who are yet to acquire a Tax ID Number (NPWP).

In the rule it is mandatory for taxable employers (Pengusaha Kena Pajak), as the providers of taxable goods (Barang Kena Pajak) and taxable services (Jasa Kena Pajak), to list information such as name, address, Tax ID number (NPWP), and ID Number (NIK) on a Tax Invoice. If the taxable employers fail to provide this information, they could potentially receive an administrative sanction, which is a 1% fine deducted from the tax base value (Dasar Pengenaan Pajak).

From the side of the recipients of taxable goods and services, they have to be more careful when it comes to either doing transactions or reporting their expenses and revenues. Every transaction involving taxable goods/services that are not final consumption or direct consumption, is considered to have business purposes. In this situation, it is more likely for the nearest Tax Office to ask questions regarding the revenue and income source of the taxpayer.

The following are the changes on regulation regarding Tax Invoice in accordance with the Directorate General of Taxes Rule Number PER-03/P/2022. First, The information that must be on the Tax Invoice regarding the handover of taxable goods/services to the recipients are name, address, Tax ID Number, and ID Number. Next, the name, Tax ID number in the Tax Invoice must be the exact match with the name and Tax ID number registered on the SKPP.

Meanwhile, the address must be a match with the registered taxable goods/services. Furthermore, you must upload the electronic Tax Invoice (E-Faktur) on the 15th of each month. Taxable employers whose all/parts of business endeavors involve the handover of taxable goods/services to final consumers via electronic trades. Finally, taxable employers who do not report their Tax Invoice will get an administrative sanction which is a 1% fine.

The government is updating the tax regulations in order to track cash flow more efficiently. Double M strives to keep you updated about the ever-changing regulations. Should you have any inquiries, please contact us.

Investing in Indonesia – As we slowly recover from the effects of Covid-19, the world economy is starting to get back on its feet. In many countries around the world, investment has been kickstarted at a very high level. According to the report released by the Indonesian Ministry of Investment/BKPM, Indonesia has received a total of IDR 310,4 trillion in foreign investments from January through June of 2022. This represents a significant increase from the figures gained in the previous year which stood at IDR 228,5 trillion. When the investments are broken down per sectors, the following are the figures:

There are two ways to interpret the list. You could see that it’s quite profitable for foreign companies to invest in the sectors listed above, seeing that they are putting in substantial amounts of funds and taking a large percentage of the total investments. On the other side, it is also viable for you to invest in other sectors not featured on the list, such as sports or creative industry. With fewer investors to compete with, it could be an interesting option for you to take a shot in these so-called out of the box options.

It is important to note that there are two common pathways for foreign investors to invest in Indonesia. First, you can try and establish your company in Indonesia. This procedure typically requires a lot of funds and there are also strict and intricate procedures you need to follow. The second pathway is to identify pre-existing Indonesian companies operating in the same sector as yours, then invest your funds within that said company and join forces as business partners. This is seen as the simpler and easier way between the two, but the difficulty comes in the process of searching for the compatible local partner. Ideally, you need to find one that suits your company’s vision, goals, values, and culture.

Before investing in Indonesia. It is important to decide whether you want to establish your own company or join forces with others. Double M can help you either way. We can help you establish your company in Indonesia or help you find local partners which suits you.

Using Payroll Vendor in Indonesia would be a wise choice for your company. Paying your employees’ in an efficient and timely manner is a true sign of a fair, committed, and trustworthy employer. Using an external payroll vendor is the best solution to help you manage, calculate, and complete your company’s payroll process. In our previous article, we have explained the reasons why you should utilize a payroll vendor in Indonesia.

Payroll, in concept, is all about timing. Salaries are paid in a fixed amount of time every month and when it comes to choosing a payroll vendor in Indonesia, you must look for one that is knowledgeable and experienced regarding the timing of executing their payroll service. For example, if you are looking to enhance your payroll system in the middle of the year, then Quarter 2 is a good time to start. Should you prefer to do it at the end of the year, some time around October is a good time so that it won’t obstruct any of your year-end processing.

In this current digitalized era, everything revolves around data. Services from Payroll Vendor in Indonesia heavily rely on the attendance data collected by the Human Resources team. It is crucial in order to assess the performance, attendance, and punctuality of the employees. Prior to choosing a payroll vendor, choose one that has integrated their payroll data in one, centralized database.

In Indonesia, employees tax are upon their earnings. In most companies, the tax deductions are straight from the salaries in order to simplify things. This process involves intricate calculation which involves many numbers and ever-changing tax regulations. So when choosing a payroll vendor or payroll provider in Indonesia, you need to pick one with proven expertise and experience in dealing with tax. It would be better if the vendor has a dedicated Tax team that takes care of all tax related matters.

We previously mentioned the importance of having an integrated database. It is important to note that data is very crucial in this process because everything will be converted and processed into the end product which is the payroll details received by the employees. The payroll vendor in Indonesia should have expertise in data analysis and data processing in order to smoothen the entire procedure.

Payroll service in Indonesia will continue on as long as the company is operating with all the employees in it. That means payroll is a key, anchor service that ensures the employees payment is efficient. With a large amount of people and large amounts of data, there could potentially be times when you need extra help and extra care from. That is precisely why you have to select a payroll vendor in Indonesia with excellent customer service that will always be one call away to help you.

Using a payroll vendor in Indonesia will revolutionize the way you compensate your employees. Double M strives to manage your company’s payroll in its entirety so you can fully focus on your business. Should you have any inquiries, please contact us.

Force majeure is a contract clause that removes liability for catastrophic, unforeseen events, extraordinary event or circumstance beyond the control of the parties, that prevent participants from fulfilling obligations.Force majeure is a clause often found in contracts which frees both parties in agreement from their respective liabilities and obligations when an extraordinary event or circumstance beyond control of both parties is happening. Generally, force majeures are divided into two main categories:

This is an instance when one of the party could not meet their end of the bargain due to natural incidents like earthquake, flood, epidemic, and mass riots

This is an instance where one of the parties failed to meet their end of the deal due to legal obstacles.

Furthermore, there are several requirements that determine whether an incident is a force majeure or not:

In Indonesian Civil Law Articles 1244 and 1245 of the ICC (Indonesian Civil Code), it is constituted that force majeure can exempt a party from its contractual obligation should there be any unpredictable circumstances beyond its control. The party would then not be held accountable for the liabilities and damages caused. After knowing the legal basis of this matter, it is important to know about the key aspects that must be clarified in the force majeure agreement and also the aftermath of the event.

In the agreement, both parties must define and agree the events that could potentially be categorized as a force majeure. For example, in musical concerts, heavy rain and thunderstorms are commonly considered as circumstances considered as force majeure. Furthermore, should the force majeure occur, the responsible party should give a detailed, chronologic, chain of events that happened during the force majeure. This explanation is very crucial to determine whether the force majeure actually happened. In relation to their responsibilities, this explanation will also determine whether they are eligible to be relieved or exempted from their end of the deal.

After the force majeure happens, the responsible party must be able to recount the aftermath. Especially, they must be able to reasonably explain how the force majeure is causing the event to fall through or making them unable to fulfill their responsibilities.

In the force majeure agreement, both parties must discuss and agree to the terms of mitigation steps should a force majeure happens. For example, outdoor musical concerts, moving the audiences to an indoor/semi-indoor stage is commonly used as a mitigation when force majeures like heavy rain and thunderstorms happen. Having clear mitigation steps and preparing it properly beforehand helps both parties take quick action should a force majeure happen.

Mitigation steps are prepared and conducted should a force majeure occur. The responsible parties must prove that mitigation steps are already taken but it could not prevent the force majeure from affecting their event/deal. By proving this, the terms agreed in the force majeure agreement will come into effect and the responsible party will be relieved from fulfilling their obligation.

Making a force majeure agreement will help protect both parties from unwanted circumstances. Double M can help you formulate a force majeure agreement in Indonesia that suits both parties.

Tax consultant in Indonesia can be very useful for a company. Upon starting your business in Indonesia, you will immediately realize that tax is an important matter in the country. Tax in Indonesia is a huge source of income for the local government. Therefore, every amount you earn as an individual or collectively as a company will be subject to tax according to the pre-existing regulations. These regulations are ever-changing and detailed which could make it hard to keep up with. As a result, the demand for tax consultants is off the charts.

Tax consultant in Indonesia is a qualified tax professional who gives advice to their clients regarding their tax obligations. After hired, tax consultant will assist and consult the client prior to making decisions regarding their tax obligations. Here are a few reasons why you should hire a tax consultant in Indonesia.

In Indonesia, companies have to pay for several taxes, such as corporate income tax, employee withholding tax, and value-added tax. Each of these taxes have different rates and different percentages. With a tax consultant in Indonesia at your disposal, you will have someone that can keep track of these rates and regulations and will be able to assist your decision-making if a regulation change ever happens.

With a tax consultant’s help, you will be able to assess your potential tax returns and find ways around the regulation which would help you save money. These alternative and smarter ways to pay tax are only known by tax consultants with a certain degree of experience and expertise in the area. Moreover, A good tax consultant will give you detailed information regarding tax report in Indonesia and explain how you can save money.

The average tax returns take about 20 hours to complete. This timeline is projected for experienced tax professionals. Now imagine if someone without previous experience in dealing with tax is asked to perform this duty, it will undoubtedly take more time and energy. A tax consultant in Indonesia gives you a reliable option to delegate your tax matters so you can save time and actually focus on running your business.

Taxes often involve the calculation and analysis of huge numbers. This is a condition that is very vulnerable to mistakes. Therefore, by hiring a tax consultant, you will have someone reliable to pay attention to all the details and make sure all the calculations are precise.

Hiring tax consultant in Indonesia will help you comply with the tax regulations in Indonesia. Double M provides tax consultancy services for all your tax-related matters. Should you have any inquiries, please contact us.

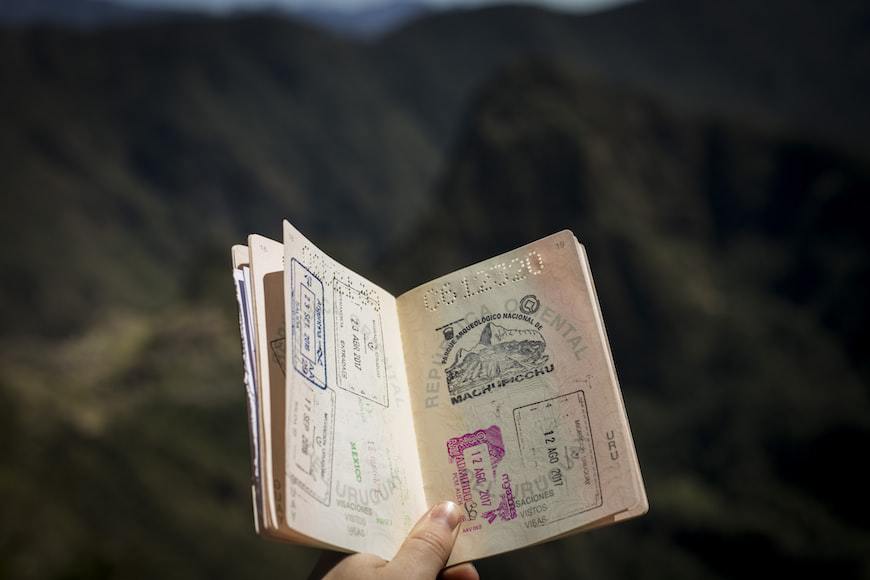

VoA in Indonesia – Traditionally, foreign tourists can obtain an Indonesian visa by processing it at the Indonesian Embassy in their country of origin. To resurrect the tourism industry after the Covid-19 pandemic, the Indonesian government introduced the Visa on Arrival (VOA).

Visa on Arrival (VoA) is a type of visa that foreign travelers can obtain instantly upon the foreign traveler’s arrival in Indonesia. Since its introduction, the VoA has now been available to use for travelers from 75 countries all around the world. As it transpired, it has proven to be a huge success.

The Minister of Tourism and Creative Economy Sandiaga Uno reported the latest update regarding tourism numbers in Indonesia. In July 2022, a sum of 476.970 foreign tourists were reportedly visiting the country. This is the highest number since the start of the Covid-19 pandemic.

The Minister said that the tourists are mostly from five countries, which are Australia, Singapore, Malaysia, India, and the United States with a rise in numbers of about 40 percent.

As we all know, Bali is one of the most prominent tourist destinations in Indonesia. The income of the people largely depends on the tourism industry itself. With the introduction of VoA in Indonesia, it makes Bali an even more enticing destination for holidays and business visits.

As the tourism industry strives to fully recover from the effects of the pandemic, the Indonesian government has also granted exemption of visiting visa to neighboring countries like the Philippines, Brunei, Laos, Malaysia, Myanmar, Singapore, Thailand, and Vietnam.

Applying for Visa on Arrival (VoA) makes your trips so much easier and hassle free. Double M is here to assist you on all Visa related matters in Indonesia.

Law Firm in Indonesia – According to the State Constitution of the Republic of Indonesia of 1945 Article 1 No. 3, Indonesia is a state based on law. Consequently, every action within the confines of the Indonesian territory are regulated by the law. As a consistent factor in many facets of life, legal services become a necessity.

Law firm in Indonesia usually becomes a go-to choice when legal services are on demand. The term law firm itself is defined as a business entity formed by two or more lawyers who are specialized in advising clients on their legal rights and responsibilities. More specifically, lawyers from law firms advise and represent their clients in civil or criminal court cases.

One of the major differences between the services offered by law firm in Indonesia and the legal services offered by Double M is that we do not offer the service of representing you in court.

Here are two main reasons why using our legal services is the best decision you can make:

As mentioned above, our legal service does not include representing the client in court. But we do offer numerous legal services such as legal advisory, legal document review and revision, legal agreement drafting, company reference check, debt collection support, and due diligence, all of which are done with impeccable standards.

When undergoing law procedures, you might run into the necessity of using other related services. At Double M, we offer to be your 360 degrees investment service, meaning that we can offer to assist you with wide-ranging, extensive multi sector services for your every need.

Are you a foreign citizen planning to live or work in Indonesia? We can help you sort out all the necessary permits. Want to establish a company in Indonesia? We can assist you complete the registration. Want to register your products for distribution in Indonesia? We will make sure you obtain the certification successfully. Want to recruit employees? our prominent Human Resources services will ensure you acquire the best talents available. Want to keep the balances in order? Our accounting and tax services will make sure everything is in place. Simply put, most law firms have one single service that we don’t offer. But we offer many services that they don’t offer.

Law firms offer you expertise and experience in their field. With such specifications, they are entitled to charge a premium fee for their services. This is down to a few reasons. Enrolling into law education and rising through the ranks to obtain the license could potentially take years off their lives. The demand is also very high, therefore enabling them to charge substantially. At Double M, legal service is one of many services we provide. Our services do not include civil/criminal court cases (which could be expensive), but rather more on legal research, legal drafting, legal translation etc. with more emphasis on regulation. As a result, we offer you a comparatively lower price but with exceptional quality.

Legal services provided by law firm in Indonesia and corporations are very different one another. Double M strives to provide you with the best legal services you could obtain in Indonesia. Should you have any inquiries, please contact us.

According to the Law of the Republic of Indonesia Number 10 of 2020 on Stamp Duty, Electronic Stamp Duty or e-Meterai is a levied tax on electronic documents. An E-Meterai serves to legally verify an electronic document, thus making it recognised as evidence in court. E-Meterai is issued by the Indonesian Government, available to be purchased at IDR 10.000, this amount is considered as tax paid to the Indonesian Government.

Over the years, Stamp Duty or Materai has existed in a physical form which is applied or stamped into a physical document. While the physical form of Stamp Duty is still recognised by the law, economic activities have evolved significantly alongside the advancements of technology. As the world becomes more digitized, the documents being used in economic activities are no longer printed with paper, but rather sent and shared in digital form.

As such, the regulations regarding this matter must also be adaptive. On October 1st 2021, the Ministry of Finance, on behalf of the Government of the Republic of Indonesia, officially launched the Electronic Stamp Duty or E-Meterai.

These are the documents that must have Electronic Stamp Duty or E-Meterai:

In a physical document, the owner is obligated to write their signature on the Stamp Duty or Meterai, half of the signature on the paper and half touching the surface of the Stamp Duty. This is done in order to verify the identity of the document’s owner. Should the document ever become disputed in court, the signature serves as evidence that the document was signed by the owner.

The legal status of digital signatures in Indonesia is validated by Article 1 Number 12 of Law Number 19 of 2016 concerning Amendments to Law Number 11 of 2008 regarding Information and Electronic Transactions (UU ITE). That being said, it can be concluded that digital signatures are recognised by law and are allowed to be used in transactions.

Image courtesy of: ZICO Law

Along with the launching of Electronic Stamp Duty/E-Materai, the usage of digital signatures has been in discussion yet again. In relation to the usage of digital signatures on E-Meterai, there has been a new regulation update. It has been confirmed that digital signatures can be used with an E-Meterai. However, there is a fundamental difference. On a physical document, the signature of the owner must touch the surface of the Stamp Duty/Meterai. Meanwhile, on a digital document, digital signatures are not allowed to touch the surface of the Electronic Stamp Duty/E-Meterai, but rather signed beside it. This is done to avoid obstructions to the QR Code that has been installed there. This particular QR Code is an important feature to ensure the validity of the Electronic Stamp Duty/E-Meterai.

Using a digital signature on E-Meterai is an implementation of technological advancement in business practices. Double M strives to help our clients’ keep track of the regulation changes relevant to their business. Should you have any inquiries, please contact us.

The most popular of all the standards, ISO 9001 — a quality management standard — has been serving businesses all over the world for more than 30 years, and its impact is rather undeniable with more than 1 million organizations across 178 countries certified to the standard.

As a market entry expert, Double M set out to deliver more than expected. In all areas of our services, we strive to provide high quality assistance to our clients. As part of this commitment, we need to prove that we meet the standard of excellence required in order to help our clients reach their goals.

On 16 August 2022, URS has recognized Double M for having met the stringent requirements of this international standard, their ongoing commitment to satisfying customers, and their dedication to continual improvement of their management system.

Becoming ISO 9001:2015 was a crucial step towards ensuring accountability not only for our process and procedures but ultimately for our end users who deserve a higher level of our investment and exporting services.

Double-M, provides professional services for companies entering South-East Asian markets. Founded in 2013 by Marc Alonso and Manuel Albores, Double M offers the most complete range of investment and commercial services. More than 100 clients have successfully developed their business in Indonesia and South East Asia supported by our multidisciplinary team, formed by local and expatriate workers.

Ultimately, the success of this achievement showcases our continued commitment to our customers to uphold standards and continue to enhance upon the experience expected from Double M.

Marc Alonso Pinos, President Director of Double M, expressed his thoughts upon the successful conclusion of the audit, “We are immensely proud of being the first market entry consultant in Indonesia with an ISO 9001:2015 certification. I hope that this achievement is the first step in our continuous efforts of giving the absolute best for our clients. That is our ultimate goal here at Double M, to always deliver more than expected.”

Furthermore, Double M’s QMS Specialists Khiara Marozzi and Riris Delima Banjarnahor said, “This first audit is a big achievement because there are no major or minor findings. We are extremely proud of the time and effort the team put into developing this process – it has become the foundation and structure of our quality system.”

After successfully achieving our strategic plan for 2022, the ISO 9001:2015 certification, we are driven to achieve the rest of our plans: continue growing our revenue, by consolidating our business development and online worldwide presence. We are strongly committed with the retention strategies, to attract and retain the best talents available. Finally, we will increase the usage of digital marketing to enhance our operations and last but not least, accelerate the implementation of new technologies to optimize our processes.